It’s getting confusing out there! If you already had a hard time making sense of administrative and service needs, things are only going to get more complicated. The industry has changed, client expectations have increased, and digital customer needs are sky-rocketing, demanding more from the insurance industry. “Dogs and cats, living together… mass hysteria!”. Customers want the convenience of Amazon, the innovation of Apple, and the value of Costco from their insurance provider.

But, what is really required today? The technology and tools have changed. Is it Self Admin? Full Admin? Or are we just required to support the Medical Underwriting or Enrollment or Billing aggregation? The list of questions goes on and on. Years ago this was much simpler, but increasingly, we’re seeing a shift in conversation from Self or Full Admin to case-specific drivers, like “Where is the source of truth? Who is responsible for keeping it current? And who is providing each service?”. We’ll leave the “Who is paying for it?” to a different blog.

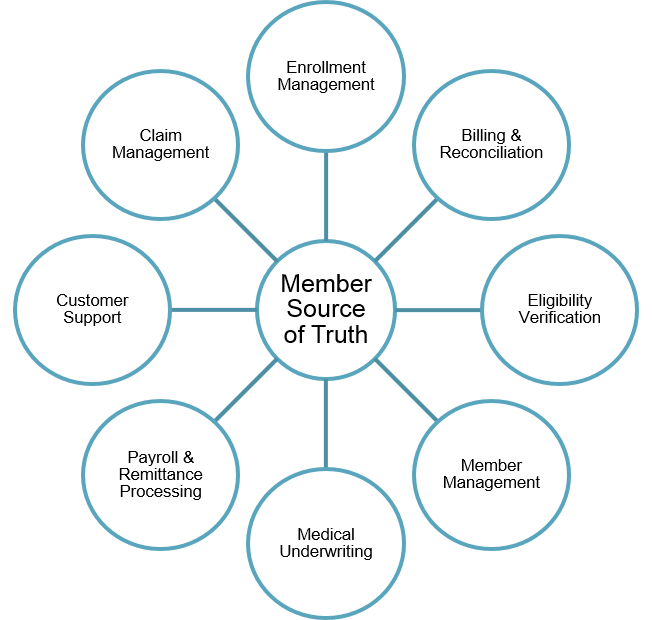

Some of the services being impacted or introduced are pictured here:

They’re all feeding into one source of truth, where records are kept up to date, eligibility is up to date, and payroll is accurate (yes, it is possible!).

This is not all encompassing. There are other medical insurance focused services or needs as well, including ACA Compliance, Cobra, etc., but that is the point. There are a myriad of service needs to administer insurance and it’s only getting more complicated.

Let’s focus on the Group Benefits market, mainly the ER funded or sponsored space for Life, Disability and Voluntary. The model we just described is a major shift from what has traditionally been in place. But, What’s the point? If you’re not noticing the shift, not preparing, or better yet, deploying solutions and strategies, you will be left behind. The point is: Things have changed. As one of my favorite artists famously wrote “The times they are a changin’…” and more poignantly “You better start swimming or you’ll sink like a stone.”

To apply this to the Group Insurance industry: If you can’t offer the services required at a case or customer level effectively, you won’t win new business, your retention percentage will decrease, and you’ll be left chasing unprofitable business – a death spiral or sink-like-a-stone sequence. Not good.

This blog series is aimed at exploring the new service responsibilities and opportunities presented to an insurer due to this shift. We will also explore how insurers can leverage technology to respond and thrive in the new administrative constructs.

The next post will look at how the evolved administrative requirements have impacted the level of customer service an Insurer must provide.

In the meantime, you might be interested in watching my Webinar from last week, which you can view here.