InsurTech Unplugged: GenAI Edition

In this edition of our InsurTech Unplugged series, Barry Duffy, VP Digital and Data, and Sarah Holdaway, VP Product ...

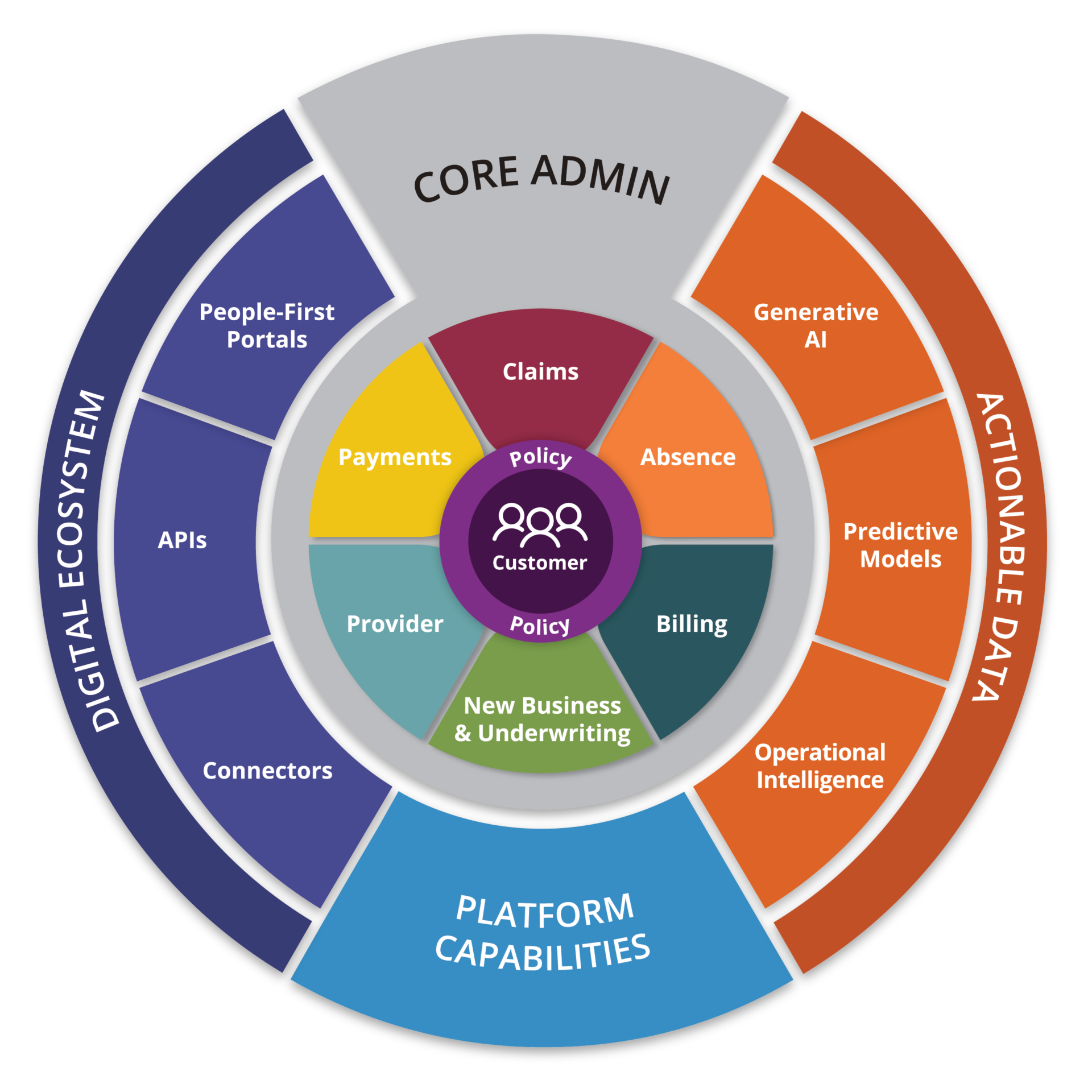

“FINEOS maintains the core platform, and we’re built to connect,” says Michael Kelly, FINEOS CEO, “as the ever-advancing employee benefits insurance industry gets more joined up.”

Legacy core systems utilized a ‘one size fits all’ business technology approach that no longer fits the needs of an agile business. Today, consumers, employers and brokers have access to powerful SaaS computing platforms and software tools that set a much higher bar for an insurer’s digital strategy.

Monolithic insurance software models of the past focused solely on details of the insurance contract. Today’s core systems focus on product, consumer, and capabilities needed to provide frictionless customer engagement opportunities. Modern digital core systems are purpose-built and component-based to connect to other parts of the value chain through standardized APIs and industry standards.

To fully reap the benefits of digital transformation, insurers must embrace this core model to deliver the frictionless service both consumers and brokers now demand.

Modern Life, Accident & Health insurance business models require digital tools that create frictionless engagement with enhanced customer experience communications patterns, partner network capabilities the ability to rapidly reconfigure ecosystem connections.

Analytical tools to better understand customer and operational data to make your business smarter and more streamlined.

Critical to the FINEOS Platform are the robust Platform Capabilities that underlie FINEOS AdminSuite, Digital Ecosystem and Actionable Data, providing technical architecture, enhanced user experiences and great analytical data.

FINEOS AdminSuite architecture is designed specifically for the Life, Accident and Health industry. A comprehensive suite, it includes absence, billing, claims, payments, policy, provider, quote, rate and underwrite. FINEOS AdminSuite is built on the robust Platform Capabilities and designed to connect to the partners and digital platforms that increasingly define the insurance landscape.